Table of Content

Your lender is required to disclose the exact amount of transfer taxes payable once you’ve identified a property. Buying property should be one of the most exciting moments of your life. From applying for a loan to finding the right location, theres a lot to consider.

Additionally, many of the older generation are downsizing and looking to sell their current homes and purchase smaller ones. The Oklahoma real estate market has seen an increase in the demand for housing in the past year. The beginning of 2017 saw a steep increase and a short fall until mid-2017. The availability of housing is down, and this can quickly drive housing prices up and more and more people compete for the available properties. Once you’ve found your dream home, there’s a good chance in today’s competitive market that you’ll be competing with other buyers.

HomePath FIRST-TIME HOMEBUYER PROGRAM

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. The conforming limits for Oklahoma counties are all at the standard $647,200.

Oklahoma City is part of the larger metropolitan area as well, and the combined population is 1,373,211 people. Oklahoma City is also the eighth largest city by land mass in the nation. Prior to the housing market collapse, Oklahoma City enjoyed a steady increase that began in the late 1980s and continued with several minor peaks and plateaus all of the ways through the 2000s. By mid-2001, Oklahoma City's housing market began a steeper climb that lasted until the market began to slow in 2007. This pattern continued until the market dropped in 2008, and in continued downward until it hit its lowest point in 2011.

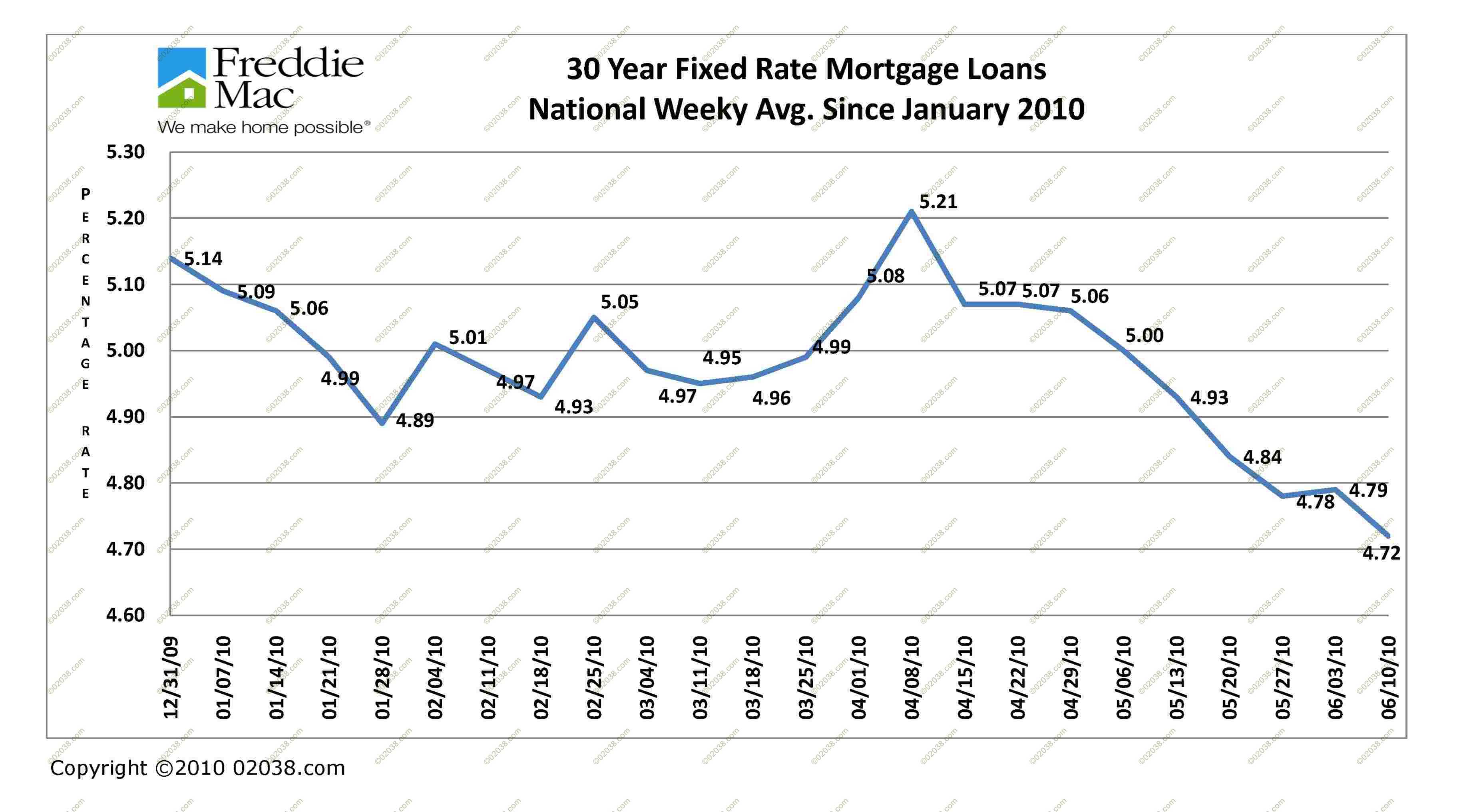

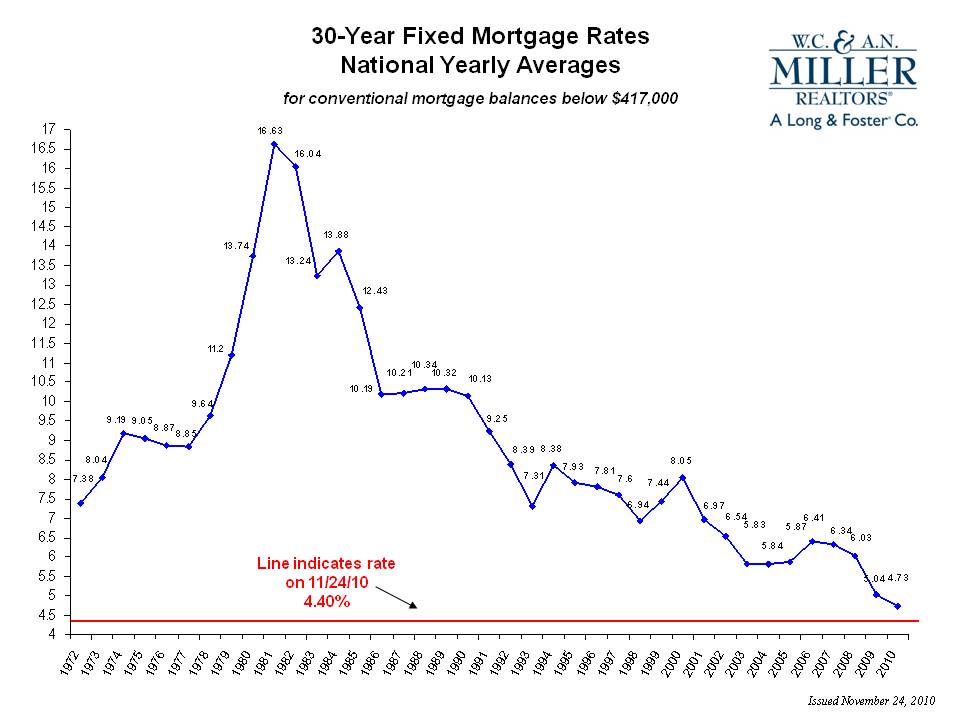

Historical Mortgage Rates In Oklahoma

Our partners cannot pay us to guarantee favorable reviews of their products or services. OKCU has competitive rates (the lowest I've seen in the metro), great customer service, a quick approval process and an easy auto loan process. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website.

Come back to this page to check current interest rates and let us know when you are ready to refinance your Oklahoma mortgage with a conventional rate and term refinance. High local affordability makes the $647,200 ceiling apply statewide for single unit homes. Dual unit homes have a limit of $828,700, triple unit homes have a limit of $1,001,650 & quadruple unit homes have a limit of $1,244,850. Residents buying premium properties in the Oklahoma City metro area may be above these thresholds, requiring a jumbo loan.

Ohfa 4teachers / Ohfa Shield

When refinancing, your home equity plays the same role that a down payment does in a home purchase. Mortgage interest rates for an Oklahoma borrower are pretty much the same whether they're buying a home or refinancing. A lot of lenders will require an appraisal during the mortgage process to determine thefair market value of a property.

Historically, Oklahoma mortgage rates have been consistently above national average mortgage rates. Check the table below for a look at the most up-to-date mortgage and refinance rates in the state. All the rate information listed here is taken from Americas top lenders. Oklahoma home equity loans are a great way for homeowners to convert the equity in their home to cash. You may consider taking out a Oklahoma home equity loan to free up extra cash, make home repairs, or finance a large purchase.

The market is predicted to rise another 2.8% over the coming year, and the price per square foot is $104. The Oklahoma City Metro area has an average home price of $136,000 and a price per square foot of $110. Both of these prices are slightly higher than Oklahoma City, and they're predicted to rise another 2.7% in the coming year. Currently, the Oklahoma housing market is doing much better than it was doing before the housing market crashed in 2007 and 2008. This is partly because of the rapidly growing economy, and the higher wages companies are paying their employees.

Balloon loans are not common for most residential buyers, but are more common for commercial loans and people with significant financial assets. BancFirst in Oklahoma offers valuable banking solutions including checking accounts, savings accounts, commercial loans, treasury services and much more. Bank online, with our mobile app, or visit a conveniently located branch near you. One of the hardest parts of buying a property is choosing the right lender. When you approach WEOKIE for a home loan, our experts are with you every step of the way so you can pick the perfect mortgage that fits your budget. We offer a variety of programs to help you find the right property, finance and close a loan, and insure your new home so you don’t have to worry.

Oklahoma has several mortgage assistance programs that are designed to help people get a mortgage and retain it until they finish paying it off. Currently, Edmond's local median home price is around $205,700, and this works out to a price per square foot of $122. These prices have gone up 1.3% in the past year, and they're supposed to go up another 2.1% in the coming year. These prices are lower than the Oklahoma City Metro area's median housing prices of $284,950. The price per square foot is more expensive than the Metro as the Metro's price per square foot is currently $110.

In addition to conventional 30-year and 15-year fixed-rate mortgages, lenders offer a wide variety of adjustable rate mortgages (ARM’s). While these instruments have lost some of their attractiveness during the recession, there are still circumstances where they offer the only way for a borrower to qualify. These loans provide interest rates that fluctuate, as the name implies. The APR is usually fixed for an initial term, such as three, five, seven or ten years.

A cash out refinance is useful for homeowners who are looking to refinance their existing Oklahoma mortgage and take cash out of their earned home equity. A Oklahoma cash out refinance allows you to take advantage of the equity you've built up in your home and pay a lower interest rate. If you are interested in seeing the latest Oklahoma mortgage refinance rates check this page often. When you buy a new home in Oklahoma, you are buying in a place that is home to a wide variety of housing options, a strong economy, and a number of beautiful natural areas. The cost of living in Oklahoma is relatively low when compared to other states in the country. In addition, the state offers a wide variety of housing options, from rural farmhouses to urban condos, making it easy to find a property that meets your needs and budget.

No comments:

Post a Comment